Potential Sectors for Investments

Overview of Foreign Direct Investment in Australia

Australia is considered as an attractive investment destination in the world mainly on account of its extensive natural resource reserves, transparent regulatory system and strong focus on innovation and technology by the Government.

The cumulative foreign direct investment position in Australia stood at USD 648 billion as of 2018. The top five sectors, which had the highest inward FDI position as of 2018, were mining and quarrying (USD 245 billion), manufacturing (USD 72 billion), financial services (USD 72 billion), real estate services (USD 68 billion) and wholesale and retail trade (USD 38 billion)105.

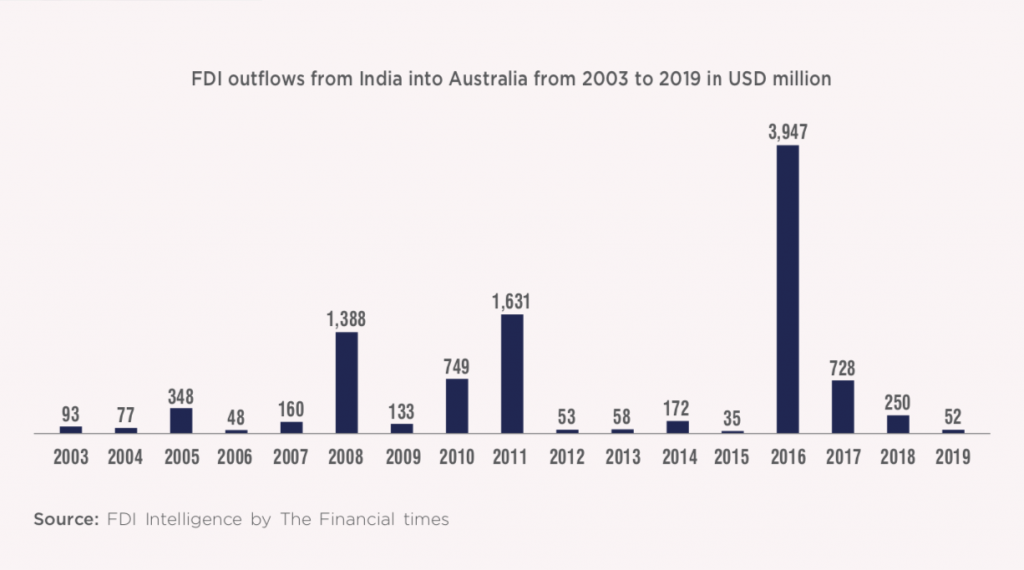

Overview of Foreign Direct Investment outflows from India into Australia

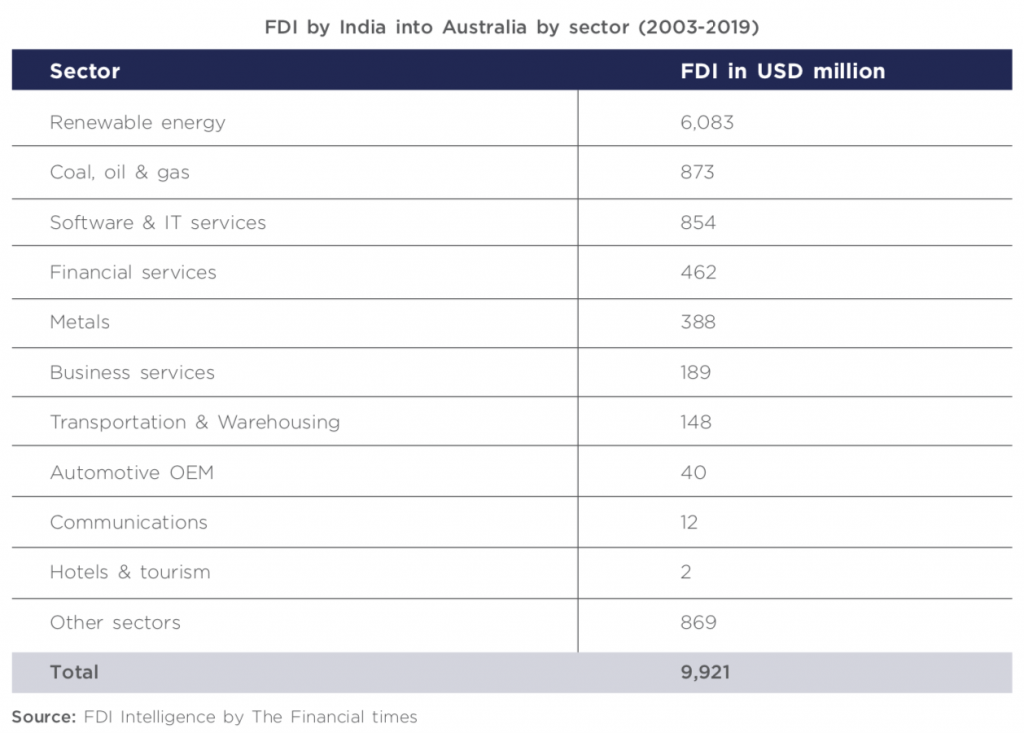

India’s total FDI in Australia (from 2003 to 2019) stood at USD 9.9 billion in 2019. India has invested in a total of 126 projects in Australia during 2003-2019. Renewable energy sector received the largest FDI (USD 6.08 billion) followed by coal, oil & gas (USD 873 million), software & IT services (USD 854 million), financial services (USD 462 million) and metals (USD 388 million).

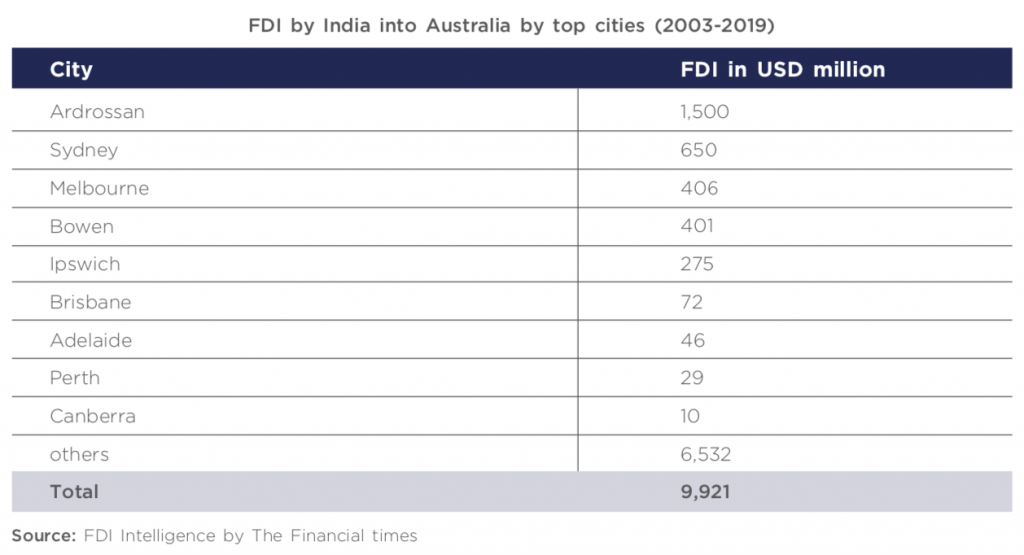

The top five cities in Australia, which received FDI from India between 2003 and 2019, are Ardrossan (USD 1.5 billion), Sydney (USD 650 million), Melbourne (USD 406 million), Bowen (USD 401 million) and Ipswich (USD 275 million).

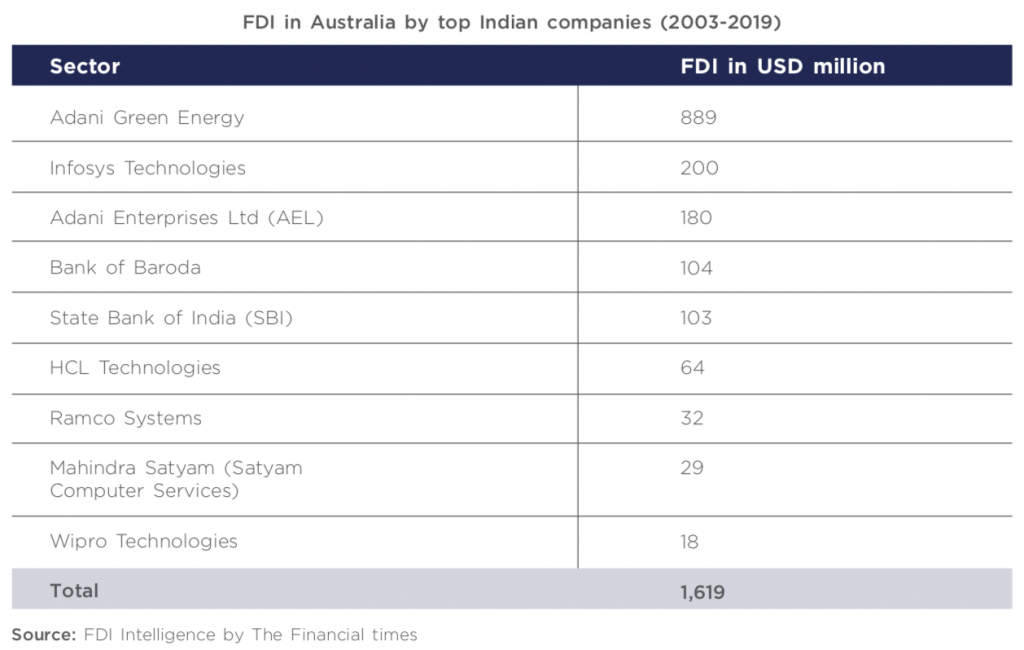

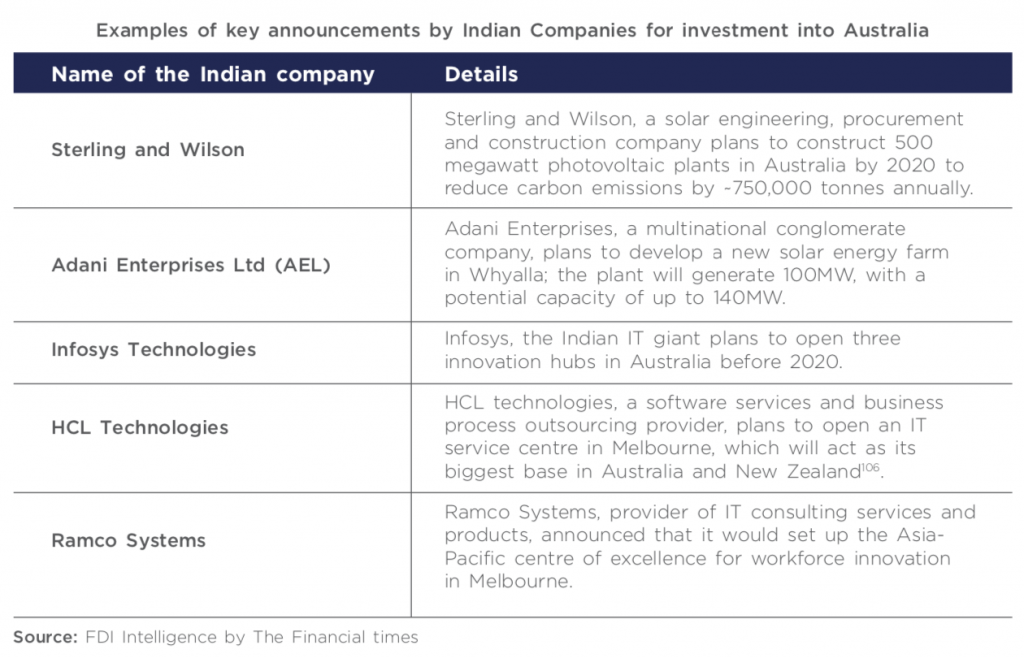

The top five Indian companies, which have invested in Australia by value of investment between 2003 and 2019, are Adani Green Energy (USD 889 million), Infosys Technologies (USD 200 million), Adani Enterprises Ltd. (AEL) (USD 180 million), Bank of Baroda (USD 104 million) and State Bank of India (USD 103 million).

In the recent past, several Indian companies have announced plans to invest in Australia. A few notable plans announced include investment in solar power by Sterling and Wilson and Adani Enterprises, opening of innovation centres by Infosys, service centres by HCL technologies and a Centre of Excellence by Ramco Systems.

Key opportunity for India

India’s FDI into Australia stood at just USD 52 million in 2019. Australia offers investment opportunities across a wide spectrum of sectors such as mining, renewable energy, agri- business and technology. India can explore the investment opportunities across these sectors to tap the Australian market, export resources required for India’s domestic consumption, or establish Australia as a base to export products across the world.

Constraints faced by Indian banks

Indian companies are required to pay withholding taxes in Australia on borrowing from their Indian parent. This leads to an increase in their cost of lending to Indian companies including banks wanting to invest in Australia.

The State Bank of India has been denied the status of an Approved Security Provider under the Financial and Performance Management Standards 2009 (FPMS). As per FPMS 2009, minimum long- term credit rating of A-/A3 from an approved credit rating agency is required. SBI has not been allowed to get the status on account of a lower rating of BBB- which is due to the lower sovereign rating of India and not due to any company specific issues. However, SBI is India’s largest public bank and is only one of the three banks recognized as Domestic Systematically Important Banks (D-SIBs) by the Indian Government. Under Section 41 of the FPMS, the Treasurer can provide exceptional approval to SBI as a security provider. The two Governments should resolve this issue as it could greatly improve the ease of funding requirements of new Indian businesses operating in Australia.

Overview of Foreign Direct Investment outflows from Australia into India

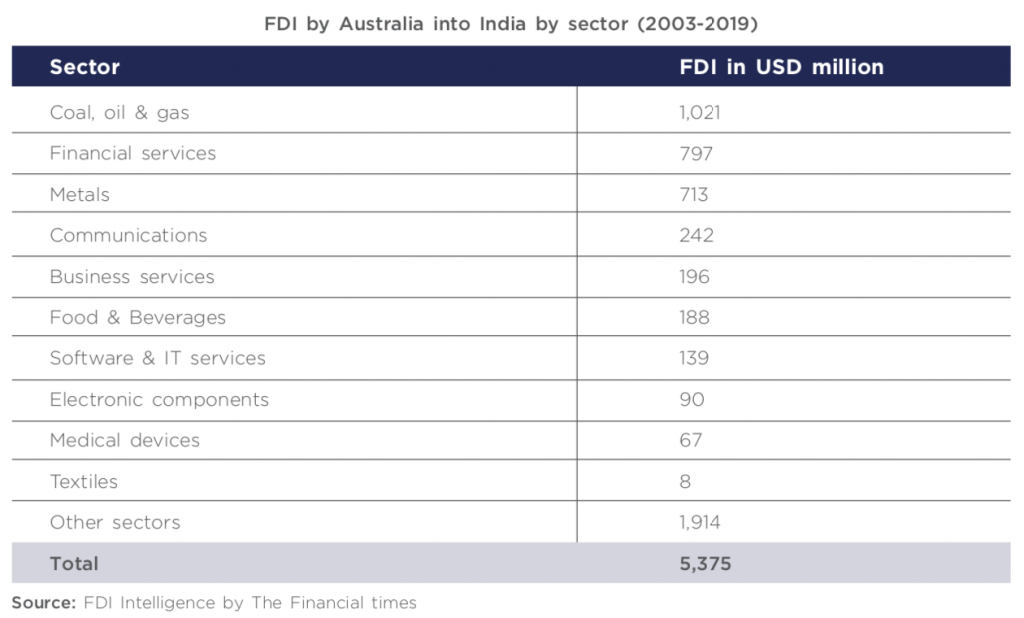

Australia’s total FDI into India (from 2003 to 2019) stood at ~USD 5.4 billion in 2019. Australia has invested in a total of 116 projects in India during 2003-2019. Coal, oil & gas sector received the largest investment (USD 1.0 billion) followed by financial services (USD 797 million), metals (USD 713 million), communications (USD 242 million) and business services (USD 196 million) between 2003 and 2019.

The top five cities in India, which received FDI from Australia are Mumbai (USD 721 million), Bangalore (USD 654 million), New Delhi (USD 392 million), Chennai (USD 391 million) and Pune (USD 360 million).

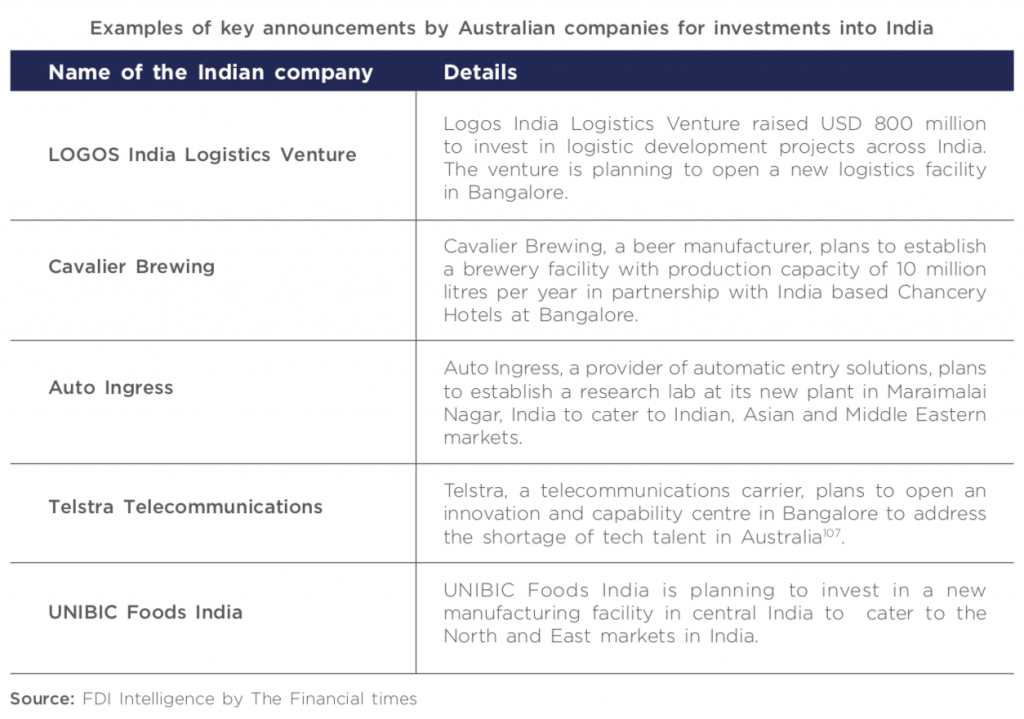

The top five Australian companies, which have invested in India by value of investment between 2003 and 2019 are LOGOS India Logistics Venture (USD 1.29 billion), Australia and New Zealand Banking Group (ANZ) (USD 210 million), BlueScope Steel (USD 203 million), Telstra Telecommunications (USD 154 million) and Cochlear (USD 67 million).

Although Australian business attitude is driven more by trade and less by investments in the recent past, several Australian companies have announced plans to invest in India. A few notable plans announced are investment in logistics development projects by LOGOS India Logistics Venture, opening of innovation centres by Telstra Telecommunications, opening of a research lab by Auto Ingress and establishment of production facilities in India by Cavalier Brewing and UNIBIC Foods.

Key opportunity for India

India being one of the fastest growing emerging economies, offers attractive opportunities across a wide range of sectors such as mining, agri-business, technology, infrastructure, tourism and manufacturing. Australian companies can invest in resource mining and exploration in India supported by robust domestic demand and favourable Government policies. India has a vibrant start-up environment catering to the evolving needs of its population, therefore offering investment opportunities for Australian investors. In agri-business, the Mega Food Parks, sanctioned by the Indian government, present attractive investment opportunities for Australia. In the recent past, Australia’s largest superannuation fund, Australian Super made a USD 1 billion investment commitment to the National Investment and Infrastructure Fund of India (NIIF), a wealth fund set up by the Government of India. With increasing population and growing urbanization, the infrastructure projects in India are expected to surge, presenting attractive investment opportunities for Australian infrastructure companies and infrastructure funds. Australian companies can also utilize the low cost labour available in India and cater to the domestic as well as global demand by setting up manufacturing facilities for mining equipment, medical devices, sports equipment, food processing equipment, automative spare parts, agricultural equipment, ferries and ships, and renewable energy equipment as well as battery cells.

105 ABS, Cat:53520, International Investment position, Australia: Supplementary statistics 2018, Table 15a and Table 15 b

106 HCL will open a 150-person Melbourne office in 2019,ARN

107 Telstra to launch Innovation and Capability Centre in Bangalore to source tech talent, Start-up Daily