Emerging Sectors

Digital Gaming and Animation

Digital Gaming

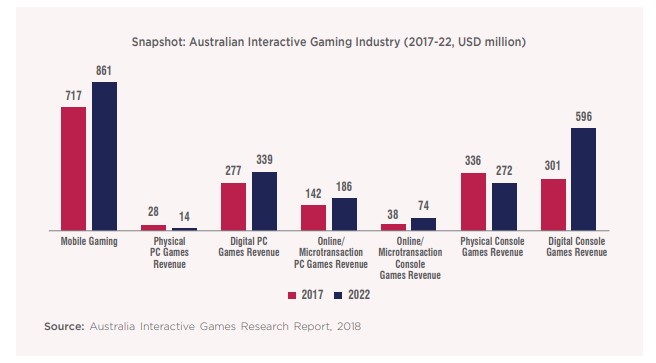

Australia has a thriving video game development industry that has been operative in the country for several years476. The digital gaming industry in Australia grew at 9% to reach ~AUD 4.5 billion (USD 3 billion) in 2017. The industry includes revenues from sales of interactive games, e-sports and in-game advertisements. Interactive games form the biggest sub-segment accounting for ~55-60% of the market. The interactive games market

is expected to grow at ~5% annually to reach ~AUD 3.3 billion (USD 2.2 billion) in 2022 from ~AUD 2.6 billion (USD 1.7 billion) in 2017477.

Initially, the Australian gaming industry operated on contracts from international clients. However, the industry has now evolved to game designing and development. As a result ~75% of the 225 gaming companies operating in Australia develop their own content and copyrights476. Some of the popular games developed in Australia include Fruit Ninja, Ski Safari, Jetpack Joyride, Crossy Road, Antichamber, L.A. Noire, De Blob, Golf Story, BioShock, Hollow Knight, etc. One of the most prominent game studios in Australia is Tantalus Media that has produced licensed games for Nintendo, DreamWorks, Disney and Nickelodeon. Big Ant Studios and Wicked Witch Software also make licensed content for third parties. In addition, the use of games in varied applications in education, medicine, architecture, supporting disability services, etc. has been gaining popularity in Australia. This has been supported by the education sector as well as by universities. For instance, the University of Melbourne has included Virtual Reality (VR) surgery in its medical curriculum, which allows medical students to perform virtual surgery on digital patients478.

The Indian digital gaming industry is also developing rapidly and is currently witnessing a surge of investments from companies such as Alibaba, Tencent, Youzu, etc. Indian game developers have gradually started catering to the global gaming industry, in addition to servicing the local market. With the growth of digital infrastructure and increase in smartphone penetration, the country’s gaming sector has grown substantially, with as many as 250 game development companies in 2018479.

Companies in India and Australia are now at a stage where they can benefit from the expertise provided by each other in the gaming industry. Collaboration with Australian companies will provide Indian companies access to knowhow and modern application methods, which will enable them to upscale technologically. In turn, Australian companies can benefit significantly through access to the Indian market, which is expected to host

310 million gamers by 2021479.

Opportunity for Australian investments in the Digital Gaming sector in India

The Indian digital gaming industry is witnessing rapid growth fueled by overseas investments. As per estimates, the industry is valued at USD 890 million in 2018 and is expected to reach USD 1.1 billion by 2020. The All India Gaming Federation (AIGF) along with the government is working on introducing FDI up to 26% in the segment. Australian investors can therefore look at investment opportunities in Indian gaming companies.

Animation

The Australian animation industry has skilled professionals, who have worked with leading Hollywood animation productions. Australia produced 69 animated TV drama titles during FY2001-10, compared to just 40 in the prior decade. Some popular films with Australian animation include Happy Feet Two and Legend of the Guardians: The Owls of Ga’Hoole.

However, the sector, in recent years, has witnessed a decline. The production in 2009-10 went down significantly480. Between FY1991 and FY2018 Australia produced only 14 animated feature films with a total duration of ~21 hours480. By 2017-18, total budgets declined by 59% and total hours lowered by 44%480.

On the other hand, the Indian animation and VFX sector has recorded an annual growth of 16% in 2017 to reach ~Rs 60 billion (USD 0.86 billion). Factors such as animation and VFX skillset of Indian professionals, combined with the cost advantages of Indian studios, are increasingly drawing Hollywood projects to India. Some large Hollywood VFX projects executed in India include movies such as Immortals, the Planet of the Apes, Life of Pi, Alvin and the Chipmunks, The Golden Compass, etc. International projects account for ~70% of the Indian VFX revenue481. The industry is estimated to grow at a CAGR of 17% during FY2017 and FY2021 to reach ~Rs 132 billion (USD 1.9 billion)481.

Given the individual positioning of both countries in this sector, collaborations can further enhance the sector in both countries. Australia can benefit from India’s global reputation to revive its animation industry. Australian animation companies can tie up with their Indian counterparts to get access to the technical expertise required for developing top-quality

animation and VFX. The combined specialization of both countries in this sector could become a formidable force to cater to the animation market, both domestically as well as to the broader international requirement.

Opportunities for Australian investments in Animation in India

FDI norms for the Indian animation and VFX sector are expected to be relaxed by the government. As per KPMG India’s Media and Entertainment Report 2019, the Indian Animation and VFX market is expected to double to USD 2.6 billion very rapidly. This will result in several investment opportunities for Australian investors in the Indian animation and VFX sector.

Recommendations

- Australian investors should be encouraged to look at opportunities in the fast growing digital gaming and animation/VFX sectors in India . Australia and India should partner each other in the digital gaming, animation/VFX sectors for mutual benefit.

476 Digital Games, Austrade

477 Australia Interactive Games Research Report, 2018

478 Virtual Reality Surgery Simulation, University of Melbourne

479 How Digital Gaming In India Is Growing Up Into A Billion-Dollar Market, 2018, Forbes

480 All Drama Production Focus on Australia, Production of Australian Animated Features and TV Drama 1990/91-2017/18, Screen Australia

481 Indian animation and VFX industry is getting bigger and better, 2017, The Economic Times