Focus Sectors

Automotive Spare Parts

Synopsis

The Indian automotive industry has established itself as a supplier of

high-quality and cost-effective auto components to global OEMs. In

2017-18, the Indian automotive component sales were estimated at

$51.2 billion, of which exports accounted for ~$13.5 billion. In contrast

to India’s growing automotive industry, Australia’s automotive industry

has been facing challenges due to relatively high production costs,

rising international competition and a relatively high exchange rate.

As a result, the automotive OEMs operating in Australia have been

importing automotive spares and parts from abroad, which presents

an opportunity for Indian automotive component manufacturers to

supply spare part to the OEMs operating in Australia. Only 0.32%

of India’s total auto-component exports were to Australia in 2018

and hence India’s exports of these components and spare parts to

Australia have significant scope for improvement.

The following opportunities can be explored in this sector:

- Increasing collaborations between Indian vehicle brands such as Tata, Mahindra and Mahindra, Maruti, etc. and niche R&D companies in Australia.

- Increasing exports of Indian auto-components and spares to Australia.

- Increasing exports by Indian tyre manufacturers to the Australian market.

The Indian automotive industry is globally recognized and contributes 2.3% to the Indian GDP.402 Having emerged as a significant contributor to the global automotive supply chain, the Indian automotive industry is a known supplier to OEMs such as BMW, General Motors, Ford, Mercedes-Benz, etc. Indian auto component and spare part manufacturers are known for their

high-quality products and low-cost components. Rapid growth in the domestic automotive market has been a prominent driver for the industry.

Increasing auto-component and spare part exports to Australia

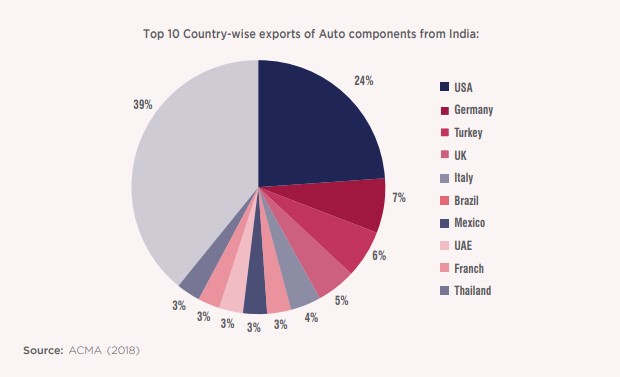

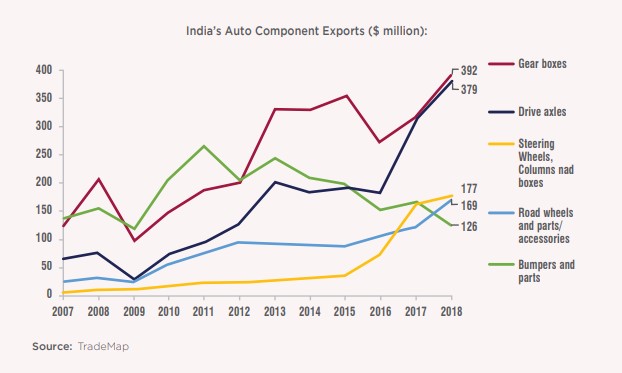

In 2017-18, the Indian automotive component industry had sales of USD 51.2 billion, of which exports accounted for USD 13.5 billion.402 India now exports to over 160 countries403. Among the top destinations, the US accounts for 24% of India’s total exports and is a key importer of brakes, servo brakes, drive-axles, road wheels, parts and gearboxes from India.

Approximately 40% of India’s total export portfolio comprises of engine, transmission and steering parts, while 60% comprises of chassis, bumpers and rubber products. According to the Automotive Components Manufacturers Association of India (ACMA), the Indian auto component industry, backed by a strong export market, is expected to generate a revenue of USD 100 billion by 2020.404

Australia’s automotive manufacturers have been facing challenges such as relatively high production costs and rising international competition405. As a consequence, the automotive OEMs operating in Australia have been relying less on local suppliers and importing automotive components and spare parts from other countries.

Over the years, automobile manufacturers in Australia have not been able to compete against auto imports from countries like Japan, Korea and Thailand post opening of the auto-market by the Australian Government and thereby reducing import duties. Indian vehicle manufacturers have also made inroads in the Australian market and exported significantly to the country till 2014-15. However, in the last few years, Indian automobile

exports to Australia have declined significantly on account of competition from countries like Thailand, Korea, Indonesia etc. Australia has eliminated import duties on automobiles for these countries whereas Indian exports to Australia attract a duty of 4.5%.

The Australian market is primarily dominated by cars imported from Asia and Europe. It is estimated that 17 million vehicles are currently running on the Australian roads. This holds significant opportunities in the service/aftermarket sector for Indian auto component suppliers.

India’s exports of automotive components to Australia have significant scope to increase. Indian auto-components and spare parts are globally competitive owing to their high quality and cost effectiveness. The presence of manufacturing facilities of large global OEMs in India is a testament to India’s highly specialized auto-manufacturing sector.

In view of the competitive environment in the Australian auto market, Indian Automobile Industry can benefit if tariffs are eliminated for Indian Automobile exports to Australia on a nonreciprocal basis by entering into an India-Australia Free Trade Agreement.

A high demand for automotive spares such as tyres in Australia also presents an opportunity for Indian tyre manufacturers to make inroads in the Australian market. Indian companies such as BKT and TAFE have already established their presence in Australia. Tractors and

Farm Equipment Limited (TAFE), a leading Indian tractor manufacturer, has partnered with AGCO Corporation and Massey Ferguson to sell its tractors in Australia. This partnership can be supported through specialized industry association visits to Australia to understand the scope of demand for tractors in the country. Given that TAFE is the third largest tractor

manufacturer in the world and the second largest in India by volume, Australia can avail of its large supply of tractors to meet its demand.

India allows 100% Foreign Direct Investment in this sector. 8% of India’s R&D expenditure is in the automotive sector. Australian companies should be encouraged to invest in India for sourcing automotive components for the Australian market and also to sell in Indian and other markets.

Collaboration with Australia on Research and Development

Australian firms are well known for their focus on research and development. Indian vehicle brands such as Tata, Mahindra and Mahindra, Maruti, etc. can collaborate with niche automotive R&D companies in Australia. Such a collaboration will enable these companies to adopt Australian design and manufacture the components at low cost in India to meet demands from Australia as well as the world. Mahindra Reva, a subsidiary of the USD 15 billion Mahindra Group, has already partnered with Swinburne University, La Trobe University, Australia Auto Collaborative Research Center and CSIRO to conduct research in zero emissions mobility solutions406.

As an example of India- Australia collaboration, Supashock, an Australian company known for its advanced motion technology, has worked with TATA for product development of commercial vehicles in India. Supashock developed and designed automotive products, such as print circuit board, sensors, etc. that were then manufactured by TATA in India.

Indian component manufacturers and industry associations, such as Automotive Component Manufacturers Association (ACMA), can tie up with their relevant Australian counterparts to avail their expertise through knowledge exchange programs, training programs and joint ventures.

Recommendations

- Organise focused and specialised industry association visits and tie ups to understand the scope of demand and to increase exports of automobile components and tyres to Australia

- Australian companies should be encouraged to invest in India for sourcing automotive components for the Australian market and also to sell in Indian and other markets.

- Indian component manufacturers and industry associations, such as Automotive Component Manufacturers Association (ACMA), should enter into tie-ups with their Australian counterparts in the form of knowledge exchange programs, training programs and joint ventures.

402 Automotive components industry in India; Madras Consultancy Group, Available at: EMIS

403 Making Indian auto component industry future-ready, Grant Thornton

404 Indian Auto Components Industry – Update, FRPT Research; Available at: EMIS

405 Future of Australia’s automotive industry: Interim Report (2015)

406 Austrade

Next topic: