Focus Sectors

Power and Renewable energy

Synopsis

Demand for electricity in Australia is on the rise and is expected

to grow at an average of 1.6% per year from 2018-22. While ~80%

of the annual electricity generated in most states in Australia is

from coal or gas power plants, ~20% of energy is generated from

renewable sources. The Australian Government has further introduced

targets at the state and federal level to encourage adoption of clean

energy. The strong growth and technological innovation expected

in this sector in Australia provides vast potential for Indian players

to cater to the solar and wind energy market in Australia.

The following opportunities can be explored in this sector:

- Investing in EPC projects in renewables in Australia and investing in solar farms.

- Importing and adopting smart grid technologies from Australia

- Exporting renewable energy equipment from India to Australia

- Collaborating with Australia on research programs for renewables.

Background

Australia’s electricity sector is currently in a period of rapid structural change. The residential demand for electricity in Australia has been on the rise as a consequence of population growth and increasing number of households. The electricity consumption in Australia is expected to grow by 1.6% per year on an average in the period 2018-22.370

The pattern of electricity usage and consumption is gradually changing in Australia with the spread of awareness of economic and environmental costs of energy usage. Renewable energy has been a contributor towards fulfilling Australia’s electricity demand for more than 3 decades and the electricity generation from renewables has more than doubled in the past decade.371

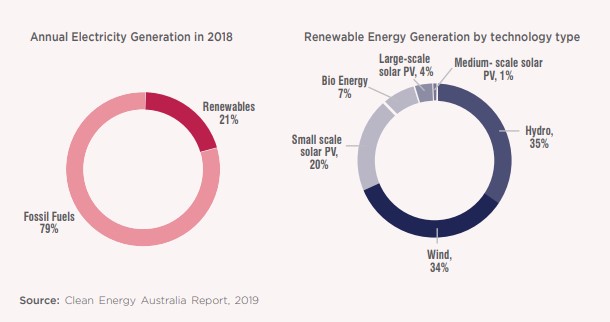

In 2018, approximately 21% of Australia’s electricity generation was from renewable sources. Renewable electricity generation in Australia is dominated by hydro-electricity followed by wind and solar power.372

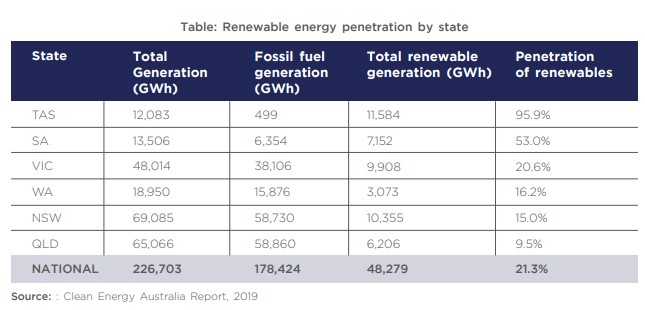

Electricity generation varies largely across Australia. While electricity in most states in Australia is coal or gas fired, renewable energy is a major source of electricity generation in Tasmania and South Australia. In Tasmania, most of the electricity generated is hydro-powered, whereas

in South Australia most electricity is wind generated.

Opportunities for partnership in Australia

Participating in Australia’s booming renewable energy market

Australia has an abundance of natural resources for renewable energy. The country is characterized by long coastlines, abundant sunshine and wind resources. In addition, the legal and regulatory frameworks, along with supportive financial measures, have resulted in the deployment of additional renewable energy installations. The Government policies have also accelerated the development and growth of renewable energy in the country.

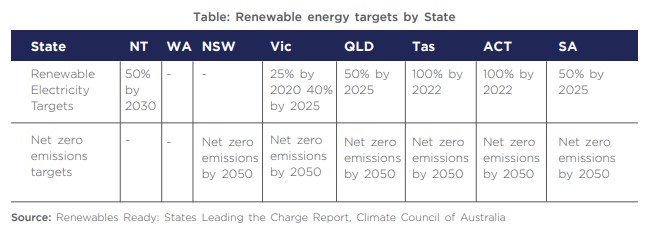

The Australian Government introduced Renewable Energy Targets (RET), which is a scheme designed to reduce emissions of greenhouse gases and increase generation of electricity from renewable sources. This scheme was first introduced in 2001 by PM John Howard. The RET scheme was expanded in January 2010 to ensure that at least 20% of Australia’s electricity is derived from renewable sources with a target of 41,000 GWh set by 2020. However, the Abbott Government in June 2015 reduced the target from 41,000 to 33,000 GWh.

Though the federal Government has currently not set up a long-term renewable energy policy, various state Governments have set up renewable energy targets of their own to encourage increasing adoption of clean energy.

Investments in the renewable energy sector in Australia have witnessed strong growth in recent years. 2017 and 2018 have been landmark years for Australia’s renewable energy sector. At the end of 2018, more than 87 large scale wind and solar projects were either in the construction phase or expected to commence operations in the near future, representing more than 5.3GW of new energy capacity and USD 7.1 billion (AUD 10 billion) in investments.372

As of December 2018, 14.6 GW of new wind and solar energy projects were under construction across Australia and investment in the renewable projects sector reached USD 14.3 billion (AUD 20 billion).

Leading states attracting investments in 2018 were:373

- Queensland – USD 4.9 billion (AUD 6.9 billion) of investment and 5,640 MW of new capacity

- Victoria – USD 3.7 billion (AUD 5.2 billion) of investment and 3,400 MW of new capacity

- New South Wales – USD 3.1 billion (AUD 4.3 billion) of investment and 350 MW of new capacity

Renewable energy can be generated at a very low cost compared to other forms of energy in Australia. In addition, Australia has been responsible for developing a large number of the world’s renewable energy technologies, especially in solar, wind and hydropower. Australia has strong support for R&D from private and public organizations and has generous R&D tax

incentives for companies in the renewable energy sector. Indian companies can thus explore this space for investments in Australia.

Indian power companies i.e. Power Generating Companies (Gencos) and Power Transmission Companies (Transcos) are looking at expanding their footprints outside India. NTPC Limited could consider investing in renewable energy as well as gas-based power plants in Australia

including collaborations on techniques such as Carbon Capture and Storage (CCS) to reduce its carbon footprint. Power Grid Corporation of India (PGCIL) could leverage on its expertise to invest in grid stability and transmission projects in Australia

Increasing exports of equipment used for harnessing renewable energy from India

Presently, majority of equipment used for harnessing wind, solar and hydro energy is imported from China. China is highly price competitive in manufacturing wind turbines, blades, solar panels, etc. and benefits accrue from the China–Australia Free Trade Agreement (ChAFTA), which covers these equipments under the zero per cent import duty. This has resulted in

companies such as Goldwind, a Chinese wind turbine company, becoming leading players in the wind energy sector in Australia.

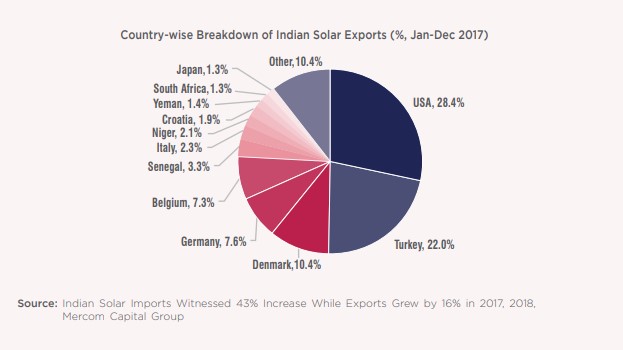

India has significant potential to export solar panels and other renewable energy equipment. While this market is predominantly import oriented in India, the sector has been growing with exports to Africa, UAE and parts of the US, albeit at a very small scale. In 2017, the U.S became the largest importer of Indian solar cells and modules, largely due to the exemption

of a 30% anti-dumping duty on its solar imports. Even while India’s share to the overall size of solar market in the US is small, researchers have speculated a positive growth in India’s exports to the U.S in the coming quarters. Apart from the U.S, India also exports solar cells and modules to Turkey, which accounts for 22% of India’s total exports and Denmark, which accounts for 10.4% of India’s total exports.374 Additionally, Indian companies can also offer support and maintenance services to Australian companies with investments in renewable energy projects in Australia.

In 2020, Sterling and Wilson Solar, India’s solar power generation firm, signed its largest EPC contract with Australia. This contract is worth over INR 2,600 crore (USD 371 million). In addition, the contract also includes an operation and maintenance contract worth INR 415 crore (USD 59.3 million) for 20 years.

Though state policies play an important role in driving the renewable energy sector in Australia, investment decisions are primarily based on costs and return on investments. The strong growth and technological innovation expected in the renewable energy sector in Australia provide

vast potential for Indian players to tap into the solar and wind energy market in Australia.

Further, apart from export of goods, Indian Central Public Enterprises under Ministry of Power may provide consultancy services with respect to expertise in areas such as Super Critical Technology in thermal power plants, equity and access issues in the distribution sector and one-nation -one grid operationalization in the transmission sector to Australian companies in this sector.

Challenges faced by Indian Investors in Australia in Power& Renewable Energy

Indian investors face the following challenges in fully harnessing the growth opportunities

provided in this sector in Australia:

- One of the most common challenges faced by Asia-specific investors in Australia is difficulties with seeking planning permits, licensing as well as access to the renewable energy grids in Australia. This lowers investor incentive despite the lucrative nature of the opportunity.

- Australia’s large landmass creates challenges to lay renewable energy-based grids. Construction of new renewable grid infrastructure requires significant planning and long-term financing, which in turn poses high risks and uncertainties for an investor.

In addition to the above, a shortage of EPC contractors in the country for grid construction is also a concern. However, considering India’s strong manpower capabilities, this challenge can be potentially mitigated by enabling a short-term visa program for skilled labor from India. This will be possible if resolved at the intergovernmental level.

Import of grid engineering technology from Australia to reduce transmission and distribution losses

Rural electrification is currently one of the highest priorities of the Ministry of Power (MoP) in India. The Government of India launched two schemes, viz., “Pradhan Mantri Sahaj Bijli Har Ghar Yojana” and “Deen Dayal Upadhyaya Gram Jyoti Yojana375” to achieve 100% rural and urban electrification.376 The Government identified 40 million rural households that did not have access to electricity and targeted them for electrification by 2018. As per the Rural Electrification Corporation (REC), India has achieved 100% electrification of villages.377

With electrification as the main priority of the country, the MoP’s next focus is expected to be on improving the performance and efficiency of the country’s power grid. Electricity losses are mainly on account of technical inefficiencies and theft. When electricity is transmitted through

the grid, the wires generate resistance causing technical losses, which can be minimized to 6-8% through usage of wires with high technical efficiency. India has attempted to reduce the technical losses by improving the efficiency in the transmission grid and adding new capacity.

“Integrated Power Development Scheme” was launched by the Government in 2014 to enhance the power transmission networks in urban regions by introducing IT based systems for tracking consumption, feeders and transformers. The Government also launched the “National Smart Grid

Mission”, which will assist the state-run power distribution companies and agencies providing finance, in planning advanced communications grids.378

Despite these reforms and upgrades, the transmission and distribution (T&D) loss, as a percentage of net electricity generated, at 21.30% in FY17 in India, is one of the highest in the world.379 In 2014, T&D losses in India were almost twice the world average and four and half times that of Australia (4.78%).380

Australia has four electricity grids (North West Interconnected System, National Electricity Market, South West Interconnected System and Darwin-Katherine Electricity Network) operating across the country. Australia has a distribution grid spanning 850,000 km and transmission grid spanning 45,000 km. The National Electricity Market grid covers the eastern and south-eastern states of Australia and the interconnected grid between these states is the longest in the world.381

Australia’s grid came under intense scrutiny after the “system black” incident occurred in South Australia, on 28th September 2016. This was followed by a number of inquiries and reports suggesting an upgrade of Australia’s ageing grid network. Australia is planning to

invest in building smart grids, which will enhance the grid’s storage capabilities, smart meters and communication within the grid. This will, in turn, help utility companies to increase their energy efficiency, increase the share of renewable energy in their portfolio and improve grid network management. Energy storage offered by smart grid, which allows renewable energy to be stored and utilized at a later time, will allow a smooth integration of renewable energy into the grid.382

Since the Indian Government has almost achieved its target of 100% rural electrification, the focus of the Government is now on improving grid efficiency through energy storage technologies and smart networks. Grid efficiency is a common cause of concern for both countries. Collaborations between the Ministry of Power in India with the Department of the Environment and Energy in Australia can greatly benefit both countries.

In 2019, The Ministry of Power, Government of India had advised State Governments and the respective Electricity Departments to convert all their existing consumer meters into smart meters in a period of 3 years. Smart meters are the third pillar of the planned technology-driven shift in global electricity systems, in addition to renewable energy and energy storage

technologies. The overall investment in smart metering is likely to be INR 150,000 Crores (USD 21.4 billion) in India, spread over a few years. There exist opportunities for Australian technology providers and investors for investing and providing smart metering technology to aid loss reduction in the Indian distribution grid, subject to Indian government provisions on

foreign investments in this sector.

Hydrogen as the future of fuel

Rising concerns of climate change and depleting resources of fossil fuels are pushing Governments worldwide to develop alternative uses of energy. Hydrogen has been emerging as an alternative fuel for transportation. In comparison to solar and wind, hydrogen has a higher energy content. Moreover, it burns with no traces of pollution and classifies as a zeroemission fuel for fuel cell vehicles. There is a notable global trend towards the adoption of hydrogen powered cars with an 80% increase in sales of fuel cell electric vehicles since 2017.383

Japan, France, Korea and the California State Governments in the US have shown an interest in new hydrogen focused strategies. In addition to these Governments, the Australian Government in 2018 issued a national hydrogen roadmap and announced its future plans to strategize its

use of hydrogen. On 4th May 2020 the Australian government launched its USD 193 million “Advancing Hydrogen Fund” with a view to expediting the development of Australia’s Hydrogen industry. The potential economic, environmental and geostrategic benefits of developing “green hydrogen” from renewables are well established and are outlined in the Australian

government’s 2019 National Hydrogen Strategy. CSIRO in Australia is conducting research on hydrogen as a clean alternative to fossil fuels and Japan has invested in this research program. Australia has a potential export opportunity for hydrogen given that the global demand for

it is expected to rise by 8 million tons by 2030.384 Australia is yet to expand the industrial capacity of hydrogen and requires further investment in infrastructure to remove barriers to market activation. However, as there are currently few applications where clean hydrogen can be used cost effectively as a fuel, investment incentives are low and the path to cost reduction and competitiveness is unclear.

India is one of the few developing countries with active research on the development of hydrogen-based transportation. In 2019, Tata Motors, in partnership with Indian Oil Corporation, innovated a hydrogen fuel-cell bus.385 This project flagged India’s growing interest in developing clean vehicles for mass transportation. Vehicle manufacturers, safety regulators, state and central Governments and research institutes from both countries can collaborate to find costeffective ways to shift towards hydrogen as a fuel for transportation. Given that Australia is well positioned to capitalize on its demand for hydrogen from Japan and Asia, India can invest

in establishing a strong bilateral trading relationship with Australia on hydrogen technologies.

Australia initiated the Hydrogen Energy Supply Chain (HESC) project for the production of sustainable hydrogen from Victorian brown coal. Collaboration with Australia may thus be initiated for converting abundant Indian brown coal to Hydrogen fuel.

International and cross-sectorial collaboration is crucial for smooth and rapid deployment of hydrogen fuel in areas such as the development of hydrogen refueling standards, construction of refueling stations and safety measures in the use, storage and transportation of hydrogen.

Opportunities for Australian investments in renewable energy sector in India

In 2019, India was ranked as the first most attractive renewable energy market in the world. The country has set an ambitious target of 175 GW of renewable power by 2022, which includes 100 GW of solar power and 60 GW from wind power. Up to 100% FDI is allowed under the automatic route for renewable energy generation and distribution projects, which is also an

opportunity for Australia.

Australia has had significant experience and possesses relevant technologies to set up Pumped Storage projects. Pumped Storage is a type of hydro-electric energy storage which works by storing water in an upper pool pumped from a second pool at a lower elevation when there is surplus power in the system. When there is demand for energy, the water in the

upper reservoir is released and as it falls, it turns turbines that create the power. There is a requirement to set up Pumped Storage projects in India to manage large scale integration of renewable sources of energy and grid balancing. This is also a possible area of collaboration and knowledge sharing with Australia.

Recommendations

- Inter-governmental discussions with relevant representation from renewable energy and power departments of both countries should be encouraged to enable easier access to planning permits, licensing and renewable energy grids for Indian investors in Australia

- India – Australia Energy Security Dialogue should be revived in order to enhance bi-lateral co-operation for mutual benefit in the electricity sector. The key areas of co-operation under the Dialogue could include adoption of clean coal, fly ash management technologies, solar forecasting and scheduling, cost effective battery technologies etc.

- Australia and India should enhance cooperation and research collaboration to further develop hydrogen fuel technologies

- Australian investors should be encouraged to look at India for renewable energy generation and distribution projects

- Collaborate with Australia to set up pump storage projects for managing large scale integration of renewable sources of energy and grid balancing

370 Economist Intelligence Unit

371 Latest official Australian energy statistics, Australian Government, Department of the Environment and Energy

372 Clean Energy Australia Report 2019, Clean Energy Council

373 Renewable energy investment hits record $20 billion in 2018, 2018, Energy Matters

374 Indian Solar Imports Witnessed 43% Increase While Exports Grew by 16% in 2017, Mercom India

375 Deen Dayal Upadhyaya Gram Jyoti Yojana, Government Schemes

376 Pradhan Mantri Sahaj Bijli Har Ghar Yojana–“Saubhagya”, Government Schemes

377 Rural Electrification Corporation, 2019

378 Energy Statistics 2018, CSO, MOSPI, table 6.10

379 Electric power transmission and distribution losses (% of output), The World Bank Group, 2018

380 U.S Energy Information Administration, 2019

381 Clean Energy Council

382 International Energy Association

383 ‘The perfect storm’: hydrogen gains ground on LNG as alternative fuel, The Guardian

384 Hydrogen: towards cleaner and sustainable transport, 2019, Deccan Herald

385 India’s first-ever hydrogen fuel cell powered bus by Tata Motors is here, 2018, Financial Express

Next topic: