Focus Sectors

Gems and Jewellery

Synopsis

The Indian gems and jewellery industry is largely export-oriented,

contributing ~12.41% to the country’s total exports and 6-7% to India’s

GDP. India has established itself as one of the largest exporters and

manufacturers of precious stones in Asia, with its exports amounting

to ~USD 40 billion in 2018.

Australia has a long geological history. While being a large supplier of

gemstones and diamonds, Australia also imports significant volumes

of gold, diamonds and jewellery from Papa New Guinea and Japan.

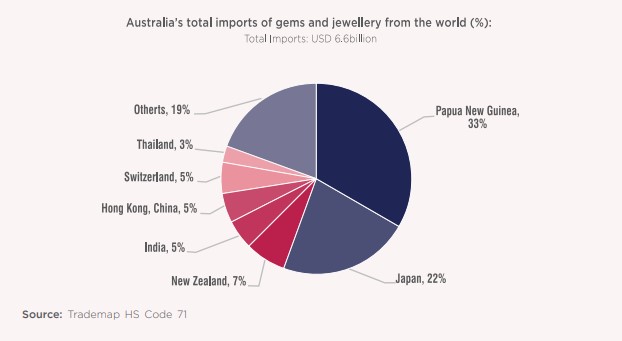

India’s current contribution is only 5% of Australia’s total imports

(USD 6.6 billion) of gemstones, thus there is significant opportunity

for India to improve its share in overall Australian imports.

The following opportunities can be explored in this sector:

- Leveraging on India’s craftsmanship in jewellery and increasing exports of Indian gems and jewellery to Australia

- Encouraging collaborations between the Gemological Association of Australia and the Indian Diamond Institute (IDI) to discuss technical and trade related aspects.

India’s Gem and Jewellery Industry

The gems and jewellery industry plays a pivotal role in the Indian economy and contributes significantly to India’s foreign exchange reserves. The industry is largely export-oriented, contributing ~12.41%395 to the country’s total exports and 6-7% to India’s GDP396. Along with China, India has established itself as one of the largest exporters of precious stones in Asia.

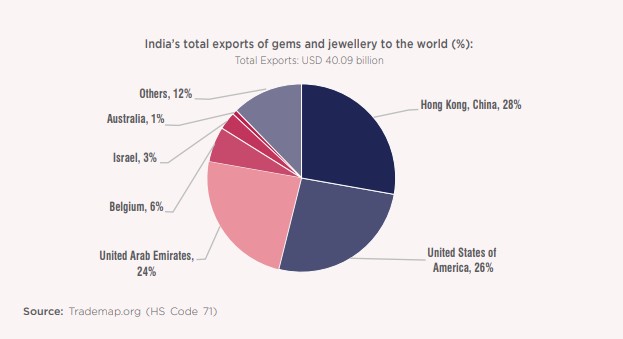

Indian exports of gems and jewellery amounted to ~USD 40 billion in 2018395 and the sector employs ~5 million people397.

India is a pioneer in diamond and jewellery manufacturing. The Indian city of Surat in Gujarat single handedly exports ~80% of the country’s diamonds and has the largest concentration of computerized diamond planners and modern machinery for jewellery-making in the country. ~90% of the world’s diamonds are cut in Surat. Jaipur is considered to be the largest hub for polishing gemstones such as tanzanite, emeralds, etc. in the country.398 The jewellery sector in India is known for its craftsmanship. From the art of enameling in Jaipur to silver filigree work in Orissa and Andhra Pradesh, different regions in India have developed their own style and design of jewellery making.

The Indian export basket consists of diamonds, jewellery, gold articles and other precious metals and stones. Exports of diamonds from India stood at USD 25.6 billion, gold coins and medallions at USD 0.8 billion, while other exports, primarily articles of jewellery with precious

stones and silver, stood at USD 12.3 billion in 2018399. India’s prominent export destinations include Hong Kong, USA and the UAE.

There are three core bodies responsible for advancing trade in this sector in India, namely the Gem and Jewellery Export Promotion Council (GJEPC), the Gem and Jewellery Trade Council of India (GJTCI) and the All India Gems and Jewelry Trade Federation (GJF). These councils also support traders in this sector by offering financial assistance and infrastructure support.

In recent years, exports have witnessed a slight dip on account of a global surge in import duties and a decline in global demand. In order to strengthen this industry, the GJEPC has established common facility centers such as Special Notified Zones for the creation of separate ITC HS code for lab grown diamonds, reduction of GST rates on certain gems and cut diamonds and the exemption of IGST on the import of silver, gold and platinum to allow the supply at nil GST to jewellery exporters400. These initiatives are expected to provide fiscal support to exporters in the industry and incentivize them to participate in international export fairs.

Australia’s Gem and Jewellery Industry

Australia has a long geological history. Even though Australia is a large supplier of gemstones and diamonds, it imported significant volumes of gold (USD 4.6 billion), diamonds (USD 0.9 billion) and jewellery (USD 0.4 billion) in 2018.395

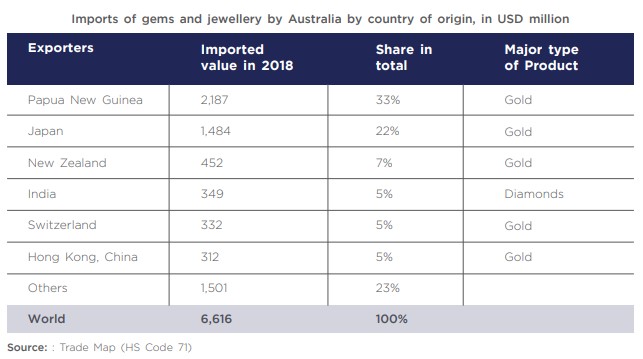

Australia imports largely from Papua New Guinea (USD 2.1 billion) for gold, silver, imitation jewellery, etc and Japan (USD 1.2 billion) for gold, pearls, platinum, etc. India features as the 4th largest import source for Australia for diamonds, rubies, sapphires, emeralds, semi-precious stones, imitation jewellery and pearls. Other key import destinations include New Zealand, Switzerland, Hong Kong (China), the US, Italy, France, Philippines, etc.395

Increasing Indian exports of jewellery and diamonds to Australia

According to the trends noted in Australia’s leading publication, Jeweller Magazine, Australia has a growing demand for rubies, emeralds, sapphires, coloured gemstones and jewellery. There is an opportunity for India to import these gemstones to Australia. In case of gold jewellery, in comparison to other Asian markets like China, Thailand and Hong Kong, India is less competitive owing to the duty levied on imports from India. In some cases, Indian companies are forced to value add in one of these Asian countries in order to minimize impact of the duties levied, making their exports more expensive and also bringing down their margins. The

two governments should engage in discussions to reduce the duties levied on Indian imports of jewellery.

Australia’s Argyle mine, responsible for majority of the country’s diamond volume, is expected to close production in 2020. The gradual decommissioning of the Argyle mine in 2019-20 is expected to significantly change the industry forecasts in the upcoming years. India can

fill in the void with its large available export volume of diamonds.

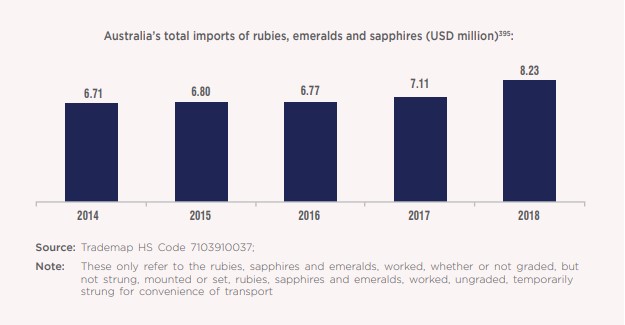

Furthermore, Australia’s imports of precious and semi-precious stones such as rubies, emeralds and sapphires have been increasing. Australia imports this largely from Thailand. India is a large exporter of these gemstones and exported ~USD 254.42 million worth of gemstones in 2018. There is thus a significant opportunity to increase Indian gemstone exports to Australia.

As the apex body of gems and jewellery industry, Gem and Jewellery Export Promotion Council (GJEPC) represents over 6,000 exporters in India. The GJPEC has undertaken several promotional activities such as annually hosting the Indian International Jewellery Show (IIJS), which is the largest trade expo for international traders. It is also responsible for organizing the first India-Australia jewellery buyer and seller meet in Mumbai in 2018.

India and Australia can work on sending trade delegations across the two countries to facilitate direct trade between Indian suppliers and Australian buyers.

India is a founding member of the Kimberley Process Certification Scheme for tracking the flow of all diamonds certified as “conflict-free” going in and out of the country. India thus has a keen interest in maintaining high standards in jewellery grading.

Established by the Ministry of Commerce and Industry and a project of the GJEPC, the Indian Diamond Institute (IDI) provides vocational education in the field of diamonds, gems and jewellery. From grading, manufacturing and designing to education on the entire spectrum of gems and jewellery, the IDI stands as a knowledge sharing partner of the GJEPC. The Gemological Association of Australia, can also collaborate with IDI on development and promotion of various technical and trade related programs. Such a collaboration will enable both organizations to benefit from mutual exchange in gem expertise, jewellery grading standards and equipment. Training programs in Australia have a large demand. For instance, Australia’s largest jewellery group, Nationwide Jewellers, received an overwhelming response of applicants for its free diamond training program launched in 2018.401

Recommendations

- Technical and training collaborations between Indian jewellery associations such as Gem and Jewellery Export Promotion Council (GJEPC) and Indian Diamond Institute (IDI) should be encouraged with Australian bodies such as the Gemological Association of Australia.

- The governments of India and Australia should hold discussions on reducing duties levied on jewellery imported from India in order to make Indian exports competitive vis a vis countries that have signed bilateral agreements with Australia.

395 Trademap (HS Code: 71)

396 Glittering India, Invest India

397 Press Information Bureau, Government of India, Ministry of Commerce & Industry

398 India Center

399 UN Trademap

400 India: Gems and Jewellery Industry; Thai Economic News Service

401 Applicants pour in for Nationwide Free Diamond Training, Jeweller Magazine

Next topic: